hotel tax calculator florida

Question State has no general sales tax. Florida Property Tax Calculator.

The Complete Guide To Hotel Status Matches Forbes Advisor

To get the hotel tax rate a percentage divide the tax per night by the cost of.

. 6 The rate becomes 15. Overview of Florida Taxes. 5 Counties must levy a lodging tax of 1 or 2 based on population.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Daily room charge shown on hotel receipt. Under Florida state law the Florida Department of Revenue.

The Interest Rates section identifies interest rates for the late payment of tax and includes instructions on how to calculate interest due. What Is The Hotel Tax In Florida. 54 rows All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms.

All of these counties with the exception of Seminole County have included a discretionary sales tax surcharge. Maximum room rate for area traveled. Overview of Florida Taxes.

Hotel Tax Calculator Florida. The calculator will show you the total sales tax amount as well as the county city and. Use ADPs Florida Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Lodging is subject to state sales tax and state hotel tax. If you make 55000 a year living in the region of Florida USA you will be taxed 9076. To use our Florida Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Your household income location filing status and number of personal exemptions. Identifying taxable rent is only the. An example of the total tax rate when staying at a Central Florida hotel would.

After entering it into the calculator it will perform the following calculationsYou pay 25000 for the new car saving you 5000. 79 rows 65 ST. Bite squad driver app.

How are hotel taxes and fees calculated. You can use our Florida Sales Tax Calculator to look up sales tax rates in Florida by address zip code. State has no general sales.

How to File and Pay Sales Tax in Pennsylvania. After a few seconds you will be provided with a full breakdown of the. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Free calculator to find the sales tax. Just enter the wages tax withholdings and other information required. So if the room costs 169 before tax at a rate of 0055 your hotel.

The Florida sales tax rate is currently. The resorttourist tax hasnt changed since 2006. If youre moving to Florida from a state that levies an income.

You are able to use our Florida State Tax Calculator to calculate your total tax costs in the tax year. TaxesSurchargesFees on hotel receipt. TaxAmount 2 Tax Amount 3 Tax.

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. That means that your net pay will be 45925 per year or 3827 per month. 4 Specific sales tax levied on accommodations.

St Johns County rate is 4 or 6 in the. Tax Amount 1. This section applies to all tax types.

It winds up being a little less than 15 350 per day.

Tax Hike Key West Passes 5 5 Tax Increase Florida Keys Weekly Newspapers

How To Register For A Sales Tax Permit In Florida Taxjar

Top 10 Cities With The Highest Average Salaries In Florida Ramseysolutions Com

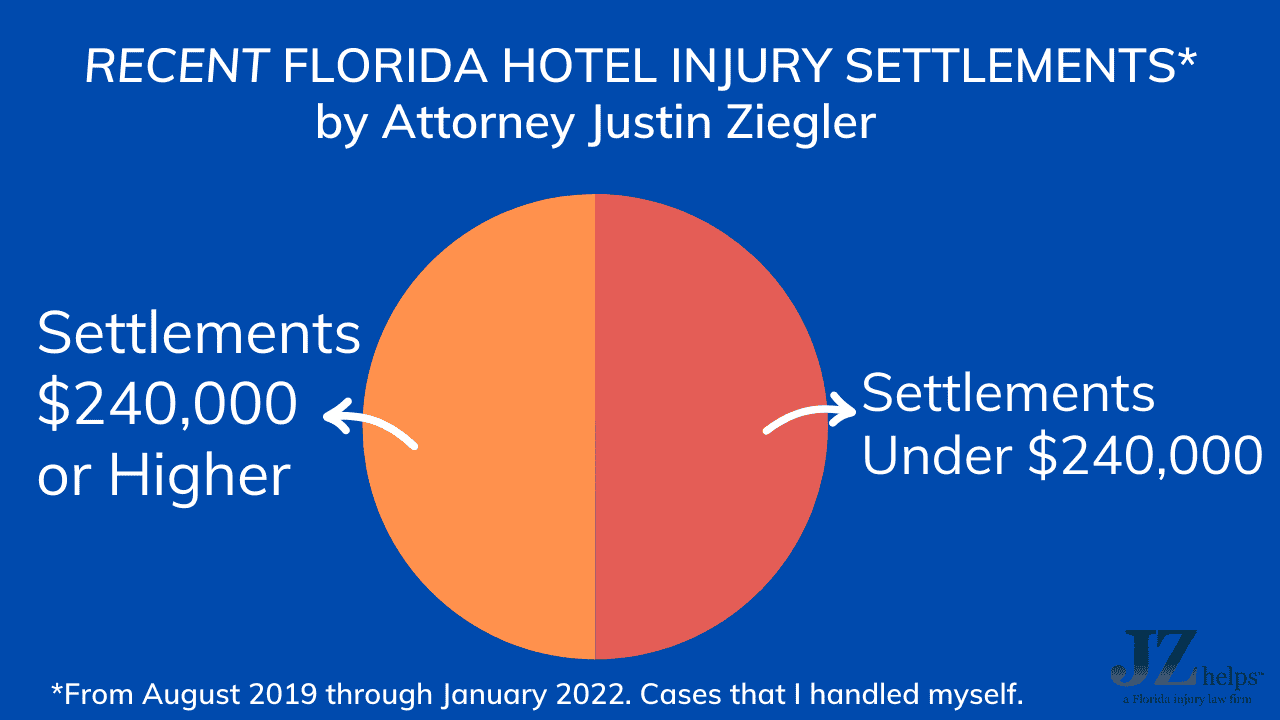

Hotel Injury Cases And Settlements In 2022 Accidents And Negligence

Florida Enacts Remote Seller Economic Nexus Grant Thornton

Stripe Tax Automate Tax Collection On Your Stripe Transactions

What Is A Florida County Tourist Development Tax

City Of Miami Beach Resort Tax

2015 Florida Hotel Tax Rates By County

Property Tax Calculator Property Tax Guide Rethority

How Much Is My Personal Injury Case Worth Settlement Formula

Lodging Taxes Add To Your Vacation S Overall Cost Don T Mess With Taxes

Sales Tax Calculation Zip Codes Are A Start But Not Enough Article

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

Florida Sales Tax Calculator Reverse Sales Dremployee

Streaming Tax Break Could Help Disney